- Sometime we need to slow down and operate at the client’s pace

- Don’t push for a meeting for a meetings sake – meet contacts where there is relevancy based on what has been delivered to other clients

- Tell stories, buyers like to hear about other peoples successes and how they have overcome challenges

- Access – you earn it and need to explain why it’s needed. Ensure you are heard, don’t rely on others to do it for you

- Sell payback & management of risk, its what buyers are measured on at the moment

- Know what you don’t know and get others involved.

December 14, 2009

Buyer turned seller

November 23, 2009

Why Sales People Need to Look Differently at Thier Contacts

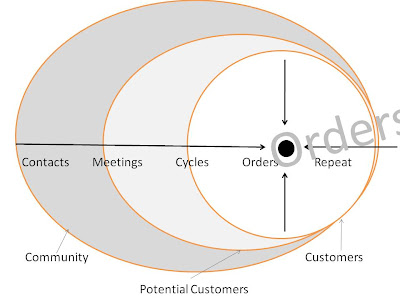

When we tell sales organizations that they must focus on nurturing contacts as opposed to generating leads, it makes immediate sense. That is because the issue of leads is fraught with all types of problems, not least of which is the fact that returns from most traditional methods of lead generation are falling through the floor.

However, after the initial burst of enthusiasm for this exciting new way to look at the problem of lead generation, most sales people and in particular their managers, need a little reassurance that it conforms with their traditional word view. ‘That is sales contacts isn’t it?’ they ask. To their surprise we answer ‘No’ adding that ‘it is buyer contacts not sales contacts that are important!’

To work through the confusion that this Zen-like response often generates, we typically ask salespeople which they would rather have – their organizations sales contacts, or the contacts of the buyer? Which ones would enable them to access and influence those to whom they want to sell?

Focusing on the Buyer’s Network

Then we ask them to imagine if they were given the buyer’s black book of! What would it look like? Whose details would it contain? How would the web of buyer contacts entangle with your own?

The contacts of relevance to the salesperson are not just buyers, but all those that can influence, or access them. Also it is not just today’s buyers, but also the potential buyers of tomorrow that the salesperson must nurture as contacts. Thus the sellers focus must be buyers and their wider community. That is how can you develop more contacts in common with buyers and the buying organizations you want to target?

Don’t Just Focus on ‘Sales Contacts’

When people think ‘sales contacts’ they tend to focus narrowly in terms of those who conform to the target profile provided by marketing, or the prequalification criteria set by sales. However, premature prequalification can be dangerous. This tends to cut the list down considerably with the sales manager, for example, arguing that ‘there is no point wasting time with people who cannot, or will not buy from us.’ In times past this was a logical approach. However, in the new reality, sellers cannot simply focus on those who have a budget and are ready to buy their solution – it simply narrows their potential market too much.

So, while we subscribe to the ideas of precision marketing and targeted sales activity, both must be relaxed somewhat at the contact stage. We all know that sales costs are rising and most of us can quickly calculate the cost of sending a sales person out to meet ‘a potential customer’ for example. We also know the cost of getting into a sales cycle and the investment that is required in order to prepare a bid. This provides a clear rational for strict prequalification.

However, if it is only a conversation, why are sellers applying the same level of prequalification as if it was a sales opportunity?

Many Conversations Will be Required

Sellers must allow some latitude in terms of the scope of contacts to be nurtured. They must be prepared to have conversations that may never go anywhere. They must be prepared to talk too many in order to get to the vital few that will eventually buy their solutions.

Sales Contacts: Named individuals in Potential Customer organizations. That is those meeting targeting and prequalification criteria.

Buyer Contacts: The list is bigger, including:

- All those who make, or influence purchase decisions

- All those who can provide access to those who make, or influence purchase decisions

- All those who could in the future make or influence buying decision (e.g. a junior person who gets promoted, or moves to another company)

- All those sources of information, advice and expertise employed by buyers

- Named individuals in the above groups can come from a wide range of sources:

- Other suppliers

- Industry counterparts

- Partners and competitors

- Consultants, or advisors

- Sources of Information / Referral

- Past colleagues/employees

- Industry experts / analysts

- Industry bodies, or professional associations

Sellers have to start and then maintain lots of conversations if they are to result in a sufficient number of sales cycles. They have to nurture many contacts if they are to end up talking to enough of the right people.

What Contacts Do You Want to Nurture?

Contacts are not just potential customers, but part of the larger community that plays a role in the buyer – seller relationship. So, it not only includes potential customers (present and future), but also those contacts who may represent sources of information, reference or introduction for example.

Contacts are individuals, not organizations. This is important because for each organization there is a diversity of contacts that are important to the seller – reflective of larger buying groups and greater stakeholder involvement in buying decisions. It is also important because contacts are fluid. For example, the contact that today is a senior engineer could be the COO tomorrow, if not in the same organization, then perhaps another.

Contacts are not just leads. They have a value, or relevance beyond this quarter, or the next. Lead generation is focused on identifying potential customers and making the sale, nurturing contacts is aimed at sustaining a conversation, generating demand and building a relationship over time. Leads are generated, but contacts are nurtured.

Sellers cannot only talk to those that are ready to buy their solutions. That means applying the same prequalification criteria to contacts, as to sales opportunities simply makes no sense. If prequalification criteria (e.g. budget, authority, timing and need) are applied too early there is the risk that the majority of potential customers could be isolated. That is because:

- Customers reveal themselves slowly – many months can elapse in a buying process before a customer appears on the vendors radar, with buyers increasingly defining requirements, building (or at last scoping) the business case and so on before engaging a vendor.

- The potential market for a sellers solution includes a majority of potential customers that either do not have a budget, or perhaps even do not recognize a need for; the solution.

- For newer companies in particular some experimentation may be required before the exact target market profile becomes clear – that is before it becomes clear which market is the most attractive and most amenable.

The nurturing of contacts involves a longer term view, one that looks beyond this quarter and the next. For this reason it can present a challenge to salespeople who are focused on meeting this quarter’s target.

Contacts are not just nurtured by sales people, but by the entire organization. However, the sales person’s black book represents only a fraction of the network of contact that an organization must nurture. In an age where buyers are shunning seller’s unsolicited advances and there in effect is no such thing as a good list to be purchased, organizations have an untapped resource in terms of the contacts of all its managers and staff.

Contacts define the relationship between an organization and its marketplace – its industry ecosystem as it were - from suppliers to competitors.

The nurturing of contacts is motivated not just by winning the next customer, but by growing existing customers and successfully delivering present projects.

Contacts are a potent sales tool. They can open doors, accelerate sales cycles and increase conversion rates beyond what is possible from traditional lead generation. That is because they leverage established relationships and good will. Compared to discredited seller marketing, introductions, referrals and contacts confer the advantage of credibility.

The Value of Conversations.

Conversations can lead anywhere and so here are some examples of how nurturing contacts can produce unexpected, yet welcome results.

- The contact in a competitor’s business who was rated as being of little value to the organization’s sales team suddenly leaves that competitor to take up a position with a buying organization in a new international market.

- The buyer who leaves the target customer with little advance warning, only to reappear in a more senior role in another even larger potential customer organization. Having failed to access this organization to date, the door is now open.

- The contact within a supplier organization through his contact with both the seller’s competitors and customers is able to advise the seller that a customer is about to make a purchase decision before it becomes generally known.

- Because the contact with past employee is nurtured, when he, or she joins a large potential customer in a senior management position the seller has an ally on the inside.

Lead Generation: Struggling to Cope with the Buying Revolution?

1.Being Heard Over the Noise

Most seller marketing is falling on deaf ears. Yet, buyers are bombarded with a confusing array of similar sounding marketing messages from competing vendors. So here is the test – can your sales and marketing message:

Grab the attention of marketing-weary buyers?

Be heard above the noise of competitors?

Enable you to stand out from the crowd?

2.Reaching Senior Buyers

The majority of purchase decisions rely on the approval of senior managers that are well buffered from unsolicited marketing outreaches. More lead generation methods are being stopped ‘dead in their tracks’ by buyer spam filters, gate keepers and other barriers erected by buyers. So, can your message:

Get through to senior managers?

Resonate with senior managers?

Get them to engage?

3.Providing Information that Buyers Actually Need

Most seller messages elicit a ‘so what?’, or ‘what else would you say!’ response from buyers. Buyers place little, or no value on most seller marketing. So here is the test:

Are you providing buyers with the type of information they want to receive?

Is it is capable of shaping the opinions, or influencing the decisions of modern buyers?

4.Shaping Requirements and Influencing the Buying Process

Buyers often keep sellers at arm’s length until the buying process is well underway. The result is that the seller arrives on the scene after requirements have been set and a competitive bidding situation has arisen. A key challenge is for the seller to become involved earlier in the buying cycle. So how successful are your efforts in:

Shaping the requirements of the buying and otherwise influencing the buying process?

Encouraging the buyer to involve you in the early stages of their buying process?

5.Creating and Sustaining A Dialogue

The ultimate test of the effectiveness of any seller marketing is the buyer engagement. However the response to most marketing is a deafening silence. The challenge is to create a dialogue, to get buyers to opt-in, to participate and to respond. That means sellers have the opportunity to really influence buyers and to be top of mind when the timing is right. So how effective is your marketing at engaging with the buyer:

Is there a reason for buyers to want to opt-in to your marketing?

Are you able to sustain an ongoing dialogue?

Is your message effective at generating a response?

6.Generating Demand

It can be a challenge to get the attention of buyers that are searching for a solution. However, those already shopping are greatly outnumbered by those who do not have a budget, or perhaps are not even aware that they have a problem. Reaching this group presents particular challenges. In particular:

How to identify those with latent needs?

How to generate demand where none already exists?

How to spur those who are not yet in shopping mode into action?

To meet these challenges of the buying revolution nothing short of a complete overhaul of traditional lead generation. That is a transition from Generating Leads to Nurturing Contacts.

Demand Generation in the 21st Century

Sales teams cannot reliably meet their numbers by simply selling to those who are ready to buy. That is because for every customer shopping for a solution there are 8 or 9 that have could buy, but don’t realize that they have a problem, or if they do don’t yet have a budget. That means sellers must sell to those who are satisfied, in the hope that they can uncover and bring to the fore a latent demand for their solution.

Why Demand Generation is Challenging

The focus on demand generation is one of the most fundamental transformations in the role of the salesperson and the sales organization. There are several reasons:

It requires new levels of confidence, knowledge and skill. That is because the salesperson’s knowledge of features and benefits is not longer sufficient. Instead he, or she must be able to connect with the customer’s business and industry drivers and to shape to the business case.

It requires a new mindset change - one that can be quite a challenge for sales managers and their teams. That is because it requires focusing effort on activities that may not contribute to this year’s target. The payback from demand generation activities, while difficult to measure is long term. So it requires a commitment of time and resources to activities that will not payback this quarter, or perhaps this year.

It requires a revision of traditional approaches to prequalification. Indeed the replacing of prequalification with marketing and nurturing. Leads are generated and prequalified as regards sales readiness. However, contacts are nurtured to sales readiness on an ongoing basis. It means replacing budget, authority, timing and need as the criteria for who to target, with profiling customers based on the basis of sector, size and so on. Of course, it does not mean that prequalification is scrapped; it just means that it is held off until a sales cycles is nascent.

It runs counter to the existing metrics and incentives used by managers and their teams. For example, compared to traditional selling that sells to people who are searching for a solution, it could double, or triple the time from first meeting to sale. It could also likely to cut conversion rate to first meeting dramatically if measured in the short term.

It requires that marketing and sales work well together – the sales person cannot do it all alone. But the marketing required is not that of the glossy brochure. Rather it centers on providing useful, relevant and credible information to the buyer (e.g. whitepapers, case studies, etc.).

Demand generation is expensive. It would be much easier to wait for competitors to generate awareness and demand in the market and then exploit it. However that is not always possible.

What Demand is to be Created?

As a first step in creating demand sellers must decide what they want to create demand for? And what fundamental need that exists in the target market - business drivers, priorities, strategies, events, and so – that can be leveraged to generating demand for the seller’s solution(s). For example:

A supply chain solutions supplier in its efforts to generate demand for its solutions among companies unaware of the need for such a solution, took advantage of a recent food safety scare to highlighted the costs associated with meeting food traceability regulations and how their solutions could reduce them.

An IT supplier surveyed its top customers to predict what their IT priorities for next year would be. With security, cost and compliance emerging as key priorities, the company wrote a series of best practice guides in each area and organized seminars to heighten awareness of these challenges and generate demand for its solutions as a result.

Fundamentally a basic need has to exist (such as the desire to cut costs, save time, ensure compliance, etc.), the objective is to create awareness of it and to bring it to the fore. The challenge of the seller is to show that the performance of the buyer’s business can be improved in a compelling way that he, or she was previously unaware of. As in all aspects of sales and marketing is important to focus demand generation efforts on the right customer and the most appropriate solution.

10 Steps to Generating Demand

1.Help buyers to evaluate and reassess their priorities by comparing them with their counterparts and peers (e.g. ‘We asked IT managers about their priorities for 2011 and here is what they said…’).

2.Quantify the problem / opportunity relating to their industry/business, using 3rd party validation to make it credible (e.g. Industry Analysts Gartner put the cost of unlicensed software at up to 30% of software budgets annually…).

3.Show them the results achieved by their peers with your solutions (e.g. ‘We have helped Company X and Y bring its award winning new products to market in just 21 weeks on a new system…’).

4.Provide useful information not marketing blurb, for example white papers, blog posts, case studies and analysts reports rather than marketing brochures.

5.Talk to those who shape priorities, allocated budgets and make decisions. That means C Level.

6.Run educational events, such as talks, seminars and webinars, where customers and experts can talk about industry challenges and how they can be resolved. Key to the success of these events is that they are focused on providing useful information, as opposed to simply a form to plug your company.

7.Position your company as a though leader, for example; writing posts, or articles, sponsoring research, or speaking at events. Seek the limelight by making the topic controversial, using it to provoke and compel buyers to sit up and take notice. Get people talking about it.

8.Link your solution with a campaign, or a cause that already has momentum. That is with something that the customer is passionate about, something that is topical, or is ‘cool’. It can be easier to rally people around a case than a product, or a service.

9.Enlist the support of others in generating demand, for example industry associations, experts and so on.

10.To be effective it must be sustained over time. It is important to note that effective demand generation is not just one activity; but a programme of activity.

November 11, 2009

Strategic Inflection: Is Our Strategy Working? Or Is It Too Early to Tell?

New Strategies, Uncertain Times

Many companies are innovating in their sales and marketing in response to a changing marketplace. Everything is being considered, the list includes;

- Launching new sales drives / initiatives

- Improving sales processes

- Changing sales structures (including greater team involvement)

- Adopting new pricing structures

- Developing new business models

- Targeting new segments, or even new markets

- Offering new products/services, or at least new variations of existing ones

- Developing new partner, or channel relationships.

Sales Strategy Questions Abound

For most companies these new strategies represent an increased commitment to sales and marketing. In many cases they entail something of a step into the unknown. So, it is little wonder that we hear sales managers (conscious of the investment of time, effort and money that is being made) asking questions, such as;

1. How quickly before we will see results and even more to the point, how quickly will we know if it is working or not? Are our assumptions regarding how long it will take, the length of sales cycles being borne out?

2. Is the strategy the right one? Is it going to work? Will it deliver the results we expect? Are our expectations regarding results realistic given our experience thus far?

3. Is our sales and marketing working? Is there enough activity? Is it the right activity?

4. Do we need to change, or refine our approach? Have we got the skills to carry this off?

5. Is the market ready, in particular, have our assumptions about the potential been realistic (especially in the context of the slowdown)

Some Observations

Even the self assured sales manager is asking these questions and asking them out loud. It's like a question and answers time in some organisations with some very interesting discussions taking place at the board room table. Listening in on these conversations we have made a few observations:

Increasingly managers are adopting a ‘get it all out in the open’, plain speaking approach to these issues. Indeed, many managers are approaching these issues with ‘brutal honesty’. They are not shying away from any of the issues involved adopting a ‘warts and all’ view of what is and is not working. All options are on the table and there are few ‘sacred cows’’ left, that includes people, or strategies.

‘Is it too early to call?’ This is an issue that comes up time and time again, particularly where long sales cycles have been lengthened further by the slowdown. Managers seem to naturally fall into two camps – one adopts the view that ‘we need to give it more time’, the other tends to want to ‘cut their losses and find another way.’ In any respect making u turns, or redirections does not seem to present problems for managers anymore. Perhaps that goes hand in hand with a turbulent market.

‘Is it the market?’ Horror stories of stalled buying decisions and cash strapped buyers are so pervasive that managers struggle to look beyond the market to find other reasons why they are slow to see results. At this point the CEO that intervenes with a ‘there is business out there we just have to work harder to find it’ is very important to the organization.

The CEO is leading the conversation, challenging the performance and challenging the assumptions. This is having a mixed response, with feathers being ruffled in some cases. The CEO who has good coaching and leadership skills is a real asset to the sales manager at this time. More than ever the CEO seems to be the touchstone for organizational confidence at this time. With people looking on, it is vital that he, or she remains un-phased and confident about the future.

In one strategy review session - an appraisal of a campaign to enter a new market segment - the CEO appeared to be distracted. He was writing in a notepad as the conversation went on around him. After a few minutes went by he showed a diagram (as presented below) outlining a process for reviewing the sales strategy, or plan. First he wanted to know how results compared with what was forecast, then whether the plan had been implemented as set out and whether the plan was still valid. It put an interesting steer on the conversation and it might be something that you can use. Food for thought.

November 10, 2009

Beware of Spreadsheet Forecasts!

10 Reasons Not To Rely on Spreadsheets for Sales Forecasting

November 04, 2009

How to Find Out What Buyers Really Want

Before a buyer buys he, or she must have a need and that need must have a certain urgency, or priority. If the seller wants to sell his, or her solutions then he, or she must clearly demonstrate how it can solve the buyer’s problem. The problem is that listing product features and benefits is an ineffective way of doing this.

To remedy this problem here is a checklist to guide you in identifying and then meeting the needs of the buyer.:

1. Avoid premature diagnosis of the solution. In other words he, or she must define the problem before prescribing a solution. Don’t make assumptions regarding the customer’s needs, or assume that he, or she needs what you are offering. Ask first and give the customer a chance to say no.

2. The expert may immediately know the problem and perhaps even the solution. However, he, or she must take care to involve the customer in the discovery and build trust along the way. Connecting with buyer’s needs, requires a consultative approach with the salesperson adopting the role of an expert, or trusted advisor.

3. Understand what stage the buyers is at:

- The need is hidden (blissful ignorance)

- The need is recognized

- They are actively looking to resolve the need.

4. Understand the company and its industry, as well as its goals and strategy. Without this the seller will struggle to understand what is motivating the buyer. Understand the tradeoffs, constraints and complicating factors that bear on the needs. Understand needs from the perspective of the different stakeholders.

5. Don’t take the buyers needs on face value. Dig beneath the surface. Look to the implications of the needs. Help the buyer to develop a clearer picture of his/her needs and the advantages of solving them.

6. More questions are not the answer. Ask better questions – those that relate to needs and their implications. Don’t ask situational questions – for example about the size of the company, how long it was established – that is information that is ‘nice to know’ as opposed to ‘need to know’, or can be found from other sources (such as the company’s web site).

7. Buyers can be slow to open up. When they hear questions they fear closing. So the seller must earn the right to ask questions. This is done by showing tact, a willingness and ability to help.

8. Be tactful and sensitive regarding how they unearth the buyer’s needs. Protect the person when identifying the problem and don’t make the buyer feel like a fool!

9. It is not enough just to listen and to understand needs, but to provoke, inspire, enthuse and engage with the seller around the opportunities and challenge facing its business.

10. The sales person must help the buyer envision life after the problem has been solved. No pain, no sale - that was the old sales philosophy, with the job of the salesperson being to find and accentuate points of pain. However, the sales pro moves beyond the pain and the problem to focus on the benefits, the vision, the business impact and the likely risks that will need to be overcome.

11. Sell to those with latent needs. The role of the salesperson now includes demand generation. That means traditional prequalification criteria no longer apply.

12. Selling higher in the organization – where priorities are set and budgets can be set in response to the identification of needs. This will require a new vocabulary and a new message. It also requires confidence and skill.

Questions About Needs:

So with those tips in mind here are some questions to help you address the buyer's needs:

- What does the buyer want to achieve?

- What does the company want to achieve?

- What are the key business drivers in this area?

- What is the underlying opportunity, or challenge facing the business? How big is it? How urgent is it?

- What is the gap between desired and actual performance in the area in question? - How does this compare with internal and external expectations?

- What are the relevant industry drivers, or trends?

- Are there any critical events, or dates?

- Who does it impact on most? How? Who else is affected? In what ways? What are the consequences? What is the cost?

- The impact on the business - has it been quantified? What are the benefits of its resolution? Are they quantified in a credible manner?

- What are the relevant metrics? How will success be measured?

- Is this area a priority? If it is why has it not been addressed to date (constraints)?

- Has the issue been address/discussed in the past? What happened as a result?

- What are the competing priorities and projects?

- How does it fit with existing people and processes?

- What are the barriers to addressing the need / exploiting the opportunity?

- What could prevent it? What constraints?

- What is the context in terms of the organisations history, culture, politics, etc?

Why Sales People Are 9 Time More Likely to Talk About Themselves!

So, how do you know where the sales person is focused? Well, listen out for the words that are used in sales pitches, presentations and proposals.

Focused on Needs | Focused Elsewhere |

Using these words means you are focused on the buyer’s needs: Challenges / Needs Problems / Opportunities Goals / Objectives Strategies Priorities Performance Gaps Metrics Results Impact Risk | Using these words suggests you are focused on your solution: Competitive advantage BenefitsFeatures Technology Unique Selling Point Value Proposition Our company, People, Skills, Capabilities, etc. Our Services, Products, or Systems ‘industry leading’, ‘best in class’, ‘innovative’, etc. Price |

To understand this better we have been considering the following questions:

- What is so difficult about finding out about the buyer’s needs before arriving at a solution?

- Why do sellers feel that they have to convince the buyer that they have the best solution before they have found out what the buyer’s problem is?

- The buyer is reluctant to reveal his, or her problem to the seller.

- The buyer says he, or she knows what is wanted and the seller accepts that this is true.

- The salesperson has been trained to talk features and benefits.

- The seller believes that his, or her solution is the best regardless of the specific needs of the customer.

- The seller assumes he, or she knows what the customer wants, so there is no need to discuss it.

- The sales person does not have the knowledge, or skill to be able to uncover the buyer’s needs.

- The problem is so obvious to the salesperson that getting straight to the solution makes sense.

- Sellers are used to selling to lower level managers, where discussions around features and technologies, can be welcomed. At senior levels they are not

- The seller assumes that the buyer can join the dots and link the solution to his, or her problem.

- Time with the buyer is limited so communicating key product information is a priority.

The Access Rules

Access to all those stakeholders in the buying decision is a privilege, not a right and if you are fortunate enough to get it, here are the rules you must follow:

- Always obey the rules regarding access, don’t go over or around others to get to who you want

- In order to ensure you access the right people, map the buying process to the organisational chart to identify you need to meet. Then pair it with your team as appropriate (e.g. CFO to your CFO).

- Tell them why you want to meet, ask them what they want to get from it and set a clear agenda in advance.

- Take advantage of other forumn for interacting with those managers of interest, for example, industry association events, conferences, etc.

- Use access sparingly and plan it to get the most from any time you have with stakeholders. That includes meeting at the right time and when the objectives or value of doing is at its most. For example, make sure you have your initial briefing, or scoping completed first.

- Do your homework in advance, make sure you are fully prepared (e.g. don’t waste time gathering information in the meeting that you could have found from the company’s website, or annual report).

- Research person you are going to meet, to understand their role, their previous positions, their qualification, any contacts that you have in common, etc.

- Consider the use of workshops that have a value to the buyer as a means of making access efficient. For example a workshop on defining requirements, completing the business case, etc.

- Make sure meetings and presentations don’t go on for longer than they have to.

- Provide the buyer with useful insights, or information to aid the decision making process.

- Provide tools and templates that can support eliciting requirements, defining the specification, building the business case and making the business decision.

- Be judicious and tactful regarding the questions you ask of the buyer, remember you have to earn the right to ask questions that are invasive, or sensitive.

- Always get permission to include them in your marketing in the future.

- Always make a point of expressing your gratitude for the time you have been granted by the buyer.

- Send a note with a summary of the meeting and some useful piece of follow-up material, or information for the buyer.

- Keep your main sponsor, or contact in the loop regarding any meetings you have with his, or her colleagues.

6 Ways Sellers Misjudge The Solution

1. Can’t See The Alternatives

The buyer has a range of alternative solutions beyond that of the seller, including do nothing, do it in-house, adopt another technology, support a competing project, etc.

The salesperson has to consider the full solutions set available to the buyer and place his, or her solution’s advantages in that context.

Increasing the real competition faced by a salesperson is not another vendor, but another project, technology, or strategy. Being aware of these alternatives is important in order to prevent surprises.

2. Confusion About The Source of Value

The buyer and seller can have a different view of the features and benefits that are most important. For example, a market research company may promote the scientific nature of its research techniques as a key selling point, however for the buyer the ability to make decisions based on the information gathered is key. The buyer is likely to want to talk to business analysts and consultants ahead of statisticians.

When sellers list of features and benefits they should stop to ask the buyer how important these are and why. That will enable them to provide the buyer with more of what he, or she is prepared to pay for and less of the rest.

3. Key Success Factors Are Not Clear

The buyer in meeting his business needs knows that the seller’s product, or service is only one element of success. In particular, there is a people and a process dimension to the buyer’s overall solution.

For example, a financial services company purchases the latest back office solution, replete with new features and technologies. However, the impact of this technology is likely to depend less on how good it is and more on how well it is implemented, in particular how it fits with the people and processes within the organisation.

Managing a programme of change around the adoption of the solution, including training and support to users, process re-engineering, etc. will have a major bearing on the seller’s success. These factors can often be overlooked by technology vendors in particular.

The solution is not the product, or the system, it is a mix of product, people and process. So what are the people, product and process dimensions of your total solution?

4. The Total Project View

The seller’s solution is only one element of an overall programme, or investment by the buyer. For example, one of our clients was negotiating the sale of its financial services solution, valued at almost 8 million, as part of a larger 120 million project in the financial institution. Knowing where its solution fits in a complex project resulted in:

• The seller being able to offer lessons from similar large scale projects

• The potential to run certain phases of the project concurrently, eliminate areas of overlap and the potential to share resources (in respect of testing for example) across a number of phases of the project

• A full appreciation of business drivers, constraints and the dependencies for the project overall.

• An understanding of how other aspects of the project could impact on the success of the seller’s implementation

• The identification of a number of project partners (e.g. the consulting house) with whom relationships should be developed.

So, how does your solution fit into the entire budget, programme, or strategy of the buyer? How will it contribute to the success of all these other things.

5. Confusion About Scope

Lately we have been advising clients to include a new section in their prospoal documents. That is a section that clearly spells out how both parties will know when the project is complete. That is the scope of the project.

Solution scope is very important and sometimes overlooked. This is important where:

• The scope of the project has not been clearly defined, or defined properly.

• The buyer’s needs change during the course of the project resulting in scope creep.

• The demands of the project have expanded now that work has started and more information is not to hand.

Agreeing what is inside and outside of the scope is very important, so too is managing scope creep as the project progresses. That is because salespeople can be tempted to promise the world when looking to close a deal. Having said this it can turn out that buyers are sometimes more realistic than sellers. They don’t, for example, expect your product or service to do everything and they do expect that there will be some setbacks involved in most projects.

6. The Underlying Motivation

The first and most common mistake with respect to matching the buyer with a solution, is to fail to fully understand the buyer's needs.

Buyers only want solutions because they fix a problem, or meet a need. In this respect it is not how a solution works, which is where sellers focus most, but the benefits that matter most.

The salesperson may have the ideal solution and may be tempted to immediately present it to the buyer. However, that could seriously hinder the sale. If the seller races ahead of the buyer to sell his, or her solution, then he or she runs the risk of getting the solution wrong, in an of the 5 ways listed above.

Arriving at the Solution

These are important reasons why the speed at which the seller arrives at defining the solution is not an advantage.

Every day sales people are forced to make assumptions regarding what buyers want, this is particularly the case where buyers chose to keep sellers at arms length. When it comes to competitive bidding situations, sellers are forced to take the buyers requirements on face value. Both of these clearly have dangers.

The seller has to arrive at the solution in tandem with the buyer – that is based on a full and thorough exploration of needs and based on a joint process of reviewing alternatives.

It is time to take account reviews out of the dark ages!

Today I witnessed another example of how the revolution in organisational buying (what we call the buying revolution) is challenging salespeople to their very core.

Today I witnessed another example of how the revolution in organisational buying (what we call the buying revolution) is challenging salespeople to their very core. Another Account Review

I had the opportunity to sit through an internal account review with a highly experienced and professional sales person earlier today. The review process was structured – clearly the person involved had done his preparation in advance of our discussion. First, he detailed the strengths and weaknesses of the seller's position in the account, as per the table below:

Our Strengths | Our weaknesses |

We have the CEO’s ear Our efforts have been showing results – the CEO has recognized this by email They have adopted our methodology in-house The work involved is work we like doing | We are under pressure on day rates The focus of our work is not as strategic as we would like Some of the key areas agreed are not being auctioned by their managers Key managers need to make a mindset shift No contact with other directors / senior managers |

Opportunities o Process re-engineering in respect of back office, value 20k, 50% probability, qtr 4 this year o Training programme for managers and staff, value 5k, 40% probability, quarter 4 this year o Product A pilot 5k, 20% probabilities o Set the ground for a new implementation in Qtr 3 of next year, value 80k, probability 30% | Risks o They may start to take us for granted o Budget – can they afford to keep using us? o Some comments have been made that call into question whether the project is addressing immediate priorities o Are expectations clear? o There is a change of management personnel pending |

The Narcissistic Account Review

But, if an account review does not look for a win-win in terms of looking to help the buyer more and in return sell more, then it is starting from the wrong place and the very health of the client relationship may be under threat.

But, if an account review does not look for a win-win in terms of looking to help the buyer more and in return sell more, then it is starting from the wrong place and the very health of the client relationship may be under threat. The salesperson’s one-sided view can be explained by the challenge of spending time with the buyer. In particular a number of meetings have been cancelled at the last minute. In any respect the last formal feedback session was all of 10 months ago! Clearly, that makes the need to sit with the buyer and to discuss his needs and the seller’s performance a real priority.

Our advice is that salespeople should treat existing accounts the same way as they do new accounts. That is with the same attention, drive to understand requirements, focus on developing relationships and so on. This avoids complacency or taking the account for granted. It also prevents making dangerous assumptions – such as that the client’s priorities are the same as they were at the time of the last sale.

Making the Change

As sales people we have been selling things one way for a long time. It is difficult to change our ways. But change is exactly what is required to cope with the new market realities. This account review not only suggested that there were opportunities to improve not just the management of this account, but the very processes and mindset applied to the management of all accounts.

Do you Understand your Buyers Complicating Factors?

When it comes to the complex sale, things are never straightforward. There are certain to be complicating factors. Understanding what exactly these are is essential to the seller’s role in successfully matching a solution to the complex needs of the buyer. If unaddressed these have the potential to scupper the sale.

The number of complicating factors involved in the typical sales is on the rise in response to the following trends in respect of today’s buying decisions:

Slower Buying Decisions– the longer a decision takes the more complex it is inevitably going to be. Against the backdrop of changing market conditions and business priorities, decisions can quickly be overtaken by events. It also means that the people involved in the decision can change during the process and this can have a major factor in derailing a potential sale. Try though as you may most sales people will struggle to accelerate the sale/buying cycle. A word of caution you run the risk of impeding the buyers buying process ever time you run ahead of them.

More People Are Involved – the more people that are involved the more complex the sale is likely to be, different stakeholders can have different, perhaps competing requirements and motivations. Getting a consensus can be a challenge as more people means more politics and it also means a greater risk of misunderstanding. Gaining access to and engaging in a meaningful way with all those now involved in making, or shaping the decision is a real challenge for the salesperson.

More sophisticated. Today’s important buying decisions are more carefully made than ever before. They are attributed by all the complexity of an important business strategy decision. That means more rigor, more information, more documentation, more oversight and so on. Buyer autonomy has been greatly restricted, with decisions being made at increasingly senior levels.

The issues of impact on the bottom line, cash flow and the balance sheet are key. More robust financial analysis is required, together with a more sophisticated investment appraisal. More feasibility type information is required, more external validation, and a robust business case. Issues of strategic fit, risk and implementation are at the top of the agenda. The discussions on these complex issues often takes place behind closed doors (a point we sales people sometimes forget).

More Risky. Today’s buying decisions are taking place in the context of greater market turbulence. In an environment of greater risk and uncertainty managers are tempted to play it safe and to delay, or postpone difficult decisions. With pressure on budgets projects are being stalled, shelved, or scrapped. Meanwhile organizational priorities have changed, with a focus on cutting costs, regaining competitiveness, managing cash and so on.

Spotting complicating factors in respect of the sale is vital to the success of the sale. Trying to close a sale when there are complicating factors that have not been resolved is not only foolish, but dangerous. It can call into question the sellers very commitment, or expertise.

This however can pose challenges for the salesperson, particularly in the context of the increasingly hands-off approach being adopted by buyers. This is certainly the case in respect of competitive tenders, for example.

The sales person must get close to the sale and more to the point the buyer if he, or she is to really understand and appreciate the full range of factors impacting on the buying decision. The seller must develop a deeper understanding of the buyer's business in order to understand his, or her impending business decision.

November 03, 2009

Is Your Sales System, or Database Working?

A checklist for getting the most from your most vital Sales & Marketing Tool.

There is one essential ingredient of effective sales and marketing in all companies - that is an up-to-date and easy to use database. It drives the sales process – from sales prospecting to account management – making the contribution of all those in sales and marketing focused, efficient and clear.

Here is a checklist to help you examine how effectively your company is using, what is potentially at least, it’s most important sales and marketing tool:

1. How widely used is the database?

· Do the user logs show regular use by key people?

· How up to date is the information?

· How thoroughly used is it (e.g. prospecting, nurturing, tasks completed, etc.)?

· Do key accounts have next actions assigned to various people and dates for completion?

· Do all priority account have an owner?

2. How easy to use is the database?

· Have users received training?

· Is good documentation available?

· Is support available? Has it been taken advantage of?

· Are key features being used?

· Is there a consistent approach to how information is updated across all users?

3. How much information does it contain?

· Number of accounts (clients, past clients, prospects, etc.), opportunities, contacts and leads?

· By sector/market?

· How representative are accounts of your company’s:

o ideal customer base/target market?

o the companies sales and marketing activity for this year?

4. How up to date is the information?

· How recent are the last modified date on key accounts, last date on actions, cases, etc.

· Is contact information on the accounts and contacts up to date?

· How much screening / cleansing of the data is undertaken?

5. How thorough/detailed is the information?

· How well kept are records, for example are there web and address details, company description, contact information, notes of actions/meetings, accurate ratings, etc.

6. How does the database comply with best practice and the law?

· Does it comply with any legal requirements re direct and database marketing (e.g. TPS (Telephone Preference Service) in the UK)

· Are opt-outs offered on any emails sent

· Does your company have a privacy policy (is it on emails, web sign-ups, etc.)

7. How well it is managed

· Does one person have responsibility for it?

· Who is responsible for keeping the information cleansed and up-to-date?

· Is administrative support available for users in such time consuming tasks as finding telephone numbers, entering new companies, mail-shots, etc?

· When is the last time there was a discussion on how the database was to be used, or developed?

· Are campaigns using the database measured for their effectiveness?

· How customised is the database to your company’s needs? Are there redundant fields? Are there important fields missing? Have drop down menus been customised?

8. How effectively is it guiding sales activity?

· How regularly do sales people log into it?

· Can the company’s present sales and marketing targets be readily identified from the database?

· Is it used as part of sales campaigns?

· Does it have up to date opportunity/forecast information?

· Are top ranked accounts easy to find and do they have next actions allocated to them?

· Can the activity level of sales people been seen from the database?

· Is it used to trigger next actions in respect of advancing sales cycles, progressing opportunities, nurturing prospects, etc.

9. How effectively is it employed:

· As a marketing tool (mail-outs, email campaigns, etc.)?

· How easy is it to use in monitoring and reporting on the success of campaigns, reporting on activity, etc.

· How effectively is it employed as a sales pipeline forecasting and management tool?

· For customer relationship management, fulfillment and other purposes?

· How well does it integrate with other systems, e.g. accounting systems?

10. How effectively is it being use in account management?

· Are customer accounts prioritised or categories in the database?

· Does it have details of account revenue targets and plans?

· Does it record notes of meetings, cases, etc.

· Does each account have an owner?

· Are the names of all decision makers, influencers in the account company identified?

· Are there a list of tasks completed and next actions in respect of managing and servicing the account?

11. How does the database perform in terms of:

· Accessibility?

· Security?

· Back-ups?

· Availability (e.g. down time, remote access, etc.)?

· Service/support?

· Does it integrate email, document storage, calendar, etc.?

· How good is the reporting function?

· What degree of customisation is available (e.g. customisable down menus, etc.)

12. Cost and payback

· What is the annual cost? Licence costs and software (if used) together with time spent gathering and updating information, undertaking mail-outs, set-up and customisation, etc.

· What is potential value of this information?

· What would the cost be if purchased, or gathered in other ways?

· Does it save people time, or make them more efficient?